New-age Relationship Management in Corporate Banking

With COVID and beyond, the rules have been re-written for how to fortify and extend strategic customer relationships in global financial services.

The impact of FinTech disruptors in a virtual world.

The rise of FinTechs was already leaving corporate banks feeling the heat. Now that the global pandemic moved RMs to engage with stakeholders in virtual only settings more often, global financial services firms are in danger of losing their grip on the most important customer relationships. New account, opportunity and stakeholder planning tools are needed to stay ahead.

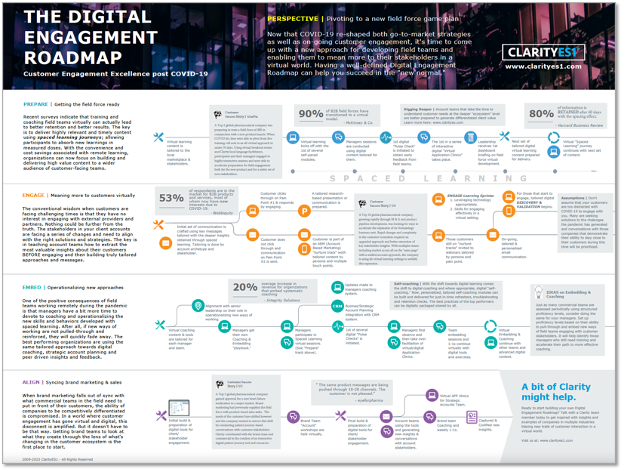

Digital customer engagement in a post-Covid world.

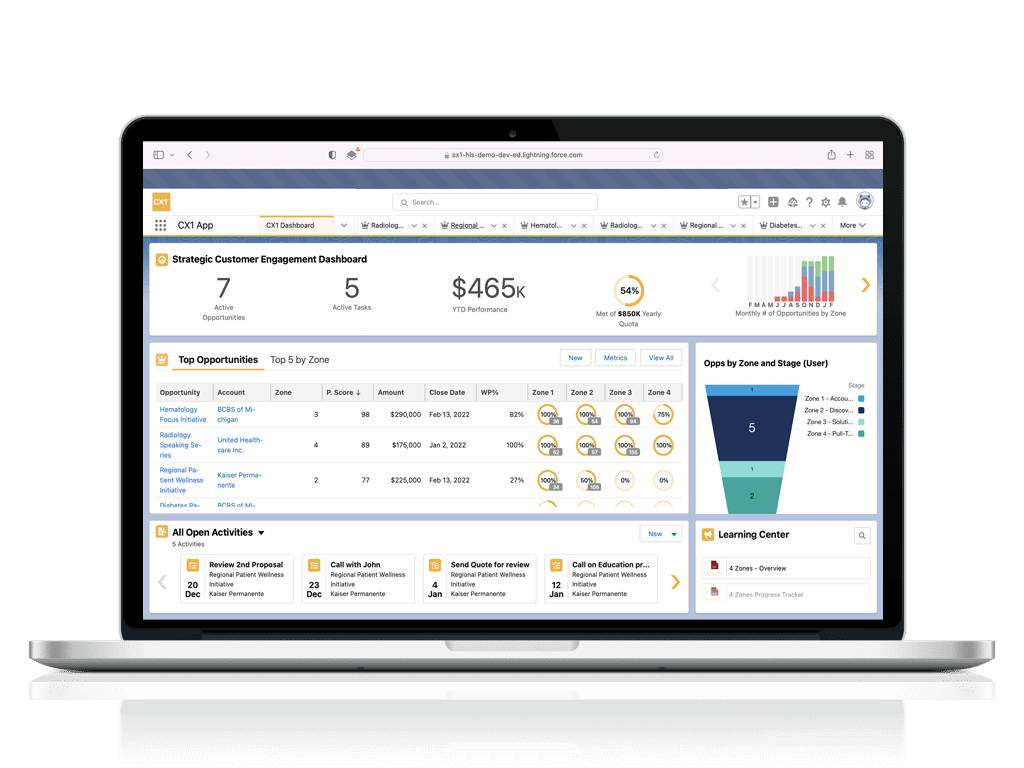

With the pace picking up and customer expectations evolving in an ever more digital, virtual world, RM’s need faster ways to create a strategic dashboard view of accounts and opportunity strategies. Having a well-defined Digital Engagement Roadmap can also help them succeed in the “new normal.”

The changing needs of global banking customers.

As global politics continue to alter trading patterns between countries, new supply routes and arrangements are being developed for which “traditional” corporate banks may not be ready. For compliance and other reasons, corporate banks continue to retrench globally at the very time clients have needs that are expanding beyond their home markets.

Can the right tech solution help? Greater speed and visibility for RMs profiling their customers and their changing needs can go a long way….